Key Takeaways

- ProShares’ Ultra XRP ETF has been listed on the DTCC under ticker UXRP, targeting twice the daily return of XRP.

- Additional XRP and Solana-based futures ETFs are planned, with ProShares aiming for a July 14 launch pending regulatory and operational factors.

Share this article

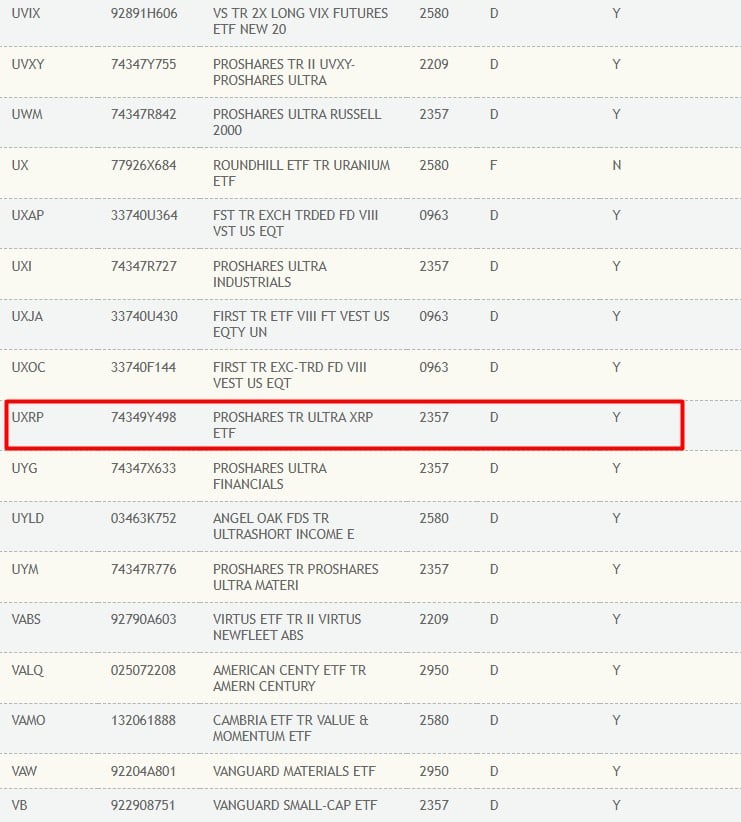

ProShares’ Ultra XRP ETF has been listed on the Depository Trust and Clearing Corporation (DTCC) under the ticker UXRP.

Inclusion on the DTCC eligibility list doesn’t guarantee immediate market debut. Still, the listing signals that the fund is operationally prepared for trading and settlement.

The fund is designed to deliver twice the daily return of XRP’s price movements. ProShares plans to launch two additional XRP-centered futures products – the Short XRP ETF and the UltraShort XRP ETF – though these have not yet appeared on the DTCC.

ProShares is targeting July 14 for the launch of all three XRP futures-based ETFs, according to a post-effective amended prospectus filed on June 24. However, the timeline is subject to change, and the company has previously postponed the effective date since the original filing in January.

The filing was submitted through a procedural mechanism that allows the products to launch without further substantive review or explicit reapproval from the SEC, provided no objections are raised before the effective date. Trading may not begin immediately on the effective date, depending on exchange readiness and other operational factors.

The top issuer of leveraged and inverse exchange-traded funds is also aiming to launch Solana-based funds, including ProShares UltraShort Solana ETF, ProShares Ultra Solana ETF, and ProShares Short Solana ETF.

Currently, only the ProShares Ultra Solana ETF appears on the DTCC listing.

Once the XRP and Solana funds are launched, ProShares will join Teucrium Investment Advisors and Volatility Shares to offer an extensive suite of crypto futures-based ETFs in the US market.

Share this article